Nassau County, situated on Long Island, N.Y., is known for its vibrant communities, quality schools, and proximity to New York City. The real estate market in this region has historically been a focal point for residential buyers and investors. In August 2024, I will explore the real estate statistics for Nassau County, examining trends in home prices, inventory levels, days on the market, and the overall economic environment influencing these metrics.

To understand the current state of the real estate market, it is crucial to consider historical trends. Over the past decade, Nassau County has seen significant fluctuations in real estate values, influenced by economic factors, demographic shifts, and changes in consumer preferences. The aftermath of the COVID-19 pandemic has also profoundly affected real estate, with many individuals and families re-evaluating their living situations, leading to increased demand for suburban properties.

In August 2024, the real estate market in Nassau County can be characterized by several key statistics:

- Median Home Prices

– The median home price is a critical indicator of market health. In August 2024, the median price might reflect year-over-year growth or decline, influenced by many factors such as interest rates, buyer demand, and economic conditions. Here are some comparisons year over year (yoy).

Residential Condos Coops

Aug 2024 Median Sale price: $765,000 $738,000 $313,500

List price: $950,000 $957,500 $349,000

YOY: 9.3%+ 12.8%+ 4.5%+

Inventory: 2114 193 181

Aug 2023 Median Sale Price: $700,000 $654,500 $300,000

Median List price: $954,500 $957,000 $349.000

- Inventory Levels:

– Available inventory is another vital statistic. A limited number of homes for sale typically indicate a seller’s market, while a larger inventory can suggest a buyer’s market. We analyze how many new listings were added in August 2024 compared to previous months and years. In August 2024, 2105 residential properties were converted into 2.6 months of inventory. Also, the supply changed and decreased by -0.06 compared to August 2023. However, demand decreased -0.12. There were 193 Condos and 181 coops that converted into 2.2 months of available inventory in August 2024. Also, the supply decreased by -3.34 and demand was up slightly by +0.10

- Days on Market:

– This metric indicates how long homes are taking to sell. A decrease in days on the market could suggest heightened competition among buyers, while an increase might indicate a cooling market. For residential properties that sold in August 2023, the median days on the market were 24 and the average 51. In August 2024, the median days on the market were 23 and the average was 45. This shows that the demand is still apparently strong.

For sales of coops and condos in August 2023, the median days on the market were 34, average was 65. In August 2024, the median days on the market were 29, average was 54. You can see, the market was still strong.

- Sales Volume:

– The total number of homes sold in August 2024 compared to previous months can provide insight into buyer activity and overall market health. As you can see from the statistics above, the number of residential sales in August 2023 was 1033 and the number in 2024 was 878. This can be attributed to several factors: still low inventory, higher prices, and increased interest rates, dampening sales.

The number of condos and coops sold in August 2023 was 122, August 2024 it was 148. This increase might be due to the still strong market, and lower cost of financing over the last eight months, and may have contributed to more affordability than a residential home, especially for those that have downsized to an apartment. The demand increased prices substantially.

Economic Influences:

The real estate market is not isolated; it is deeply intertwined with larger economic factors. In August 2024, we would consider the impact of:

-Interest Rates: Higher interest rates can dampen buyer enthusiasm, while lower rates can stimulate market activity.

– Employment Rates: Job growth in Nassau County may influence the demand for housing, as individuals seeking employment may look to relocate to the area.

– Consumer Confidence: The overall sentiment of consumers regarding the economy can significantly impact their willingness to invest in real estate.

Neighborhood Insights

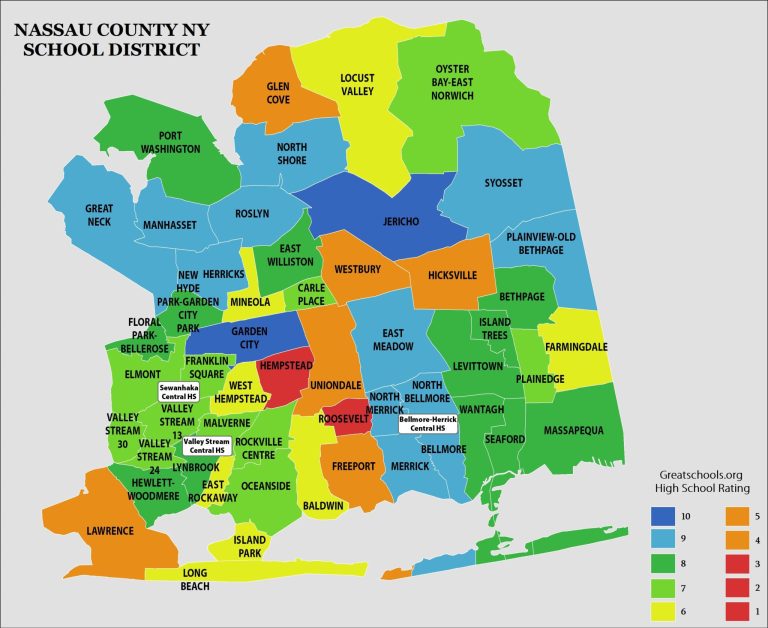

Nassau County is home to diverse neighborhoods, with unique characteristics and market dynamics.

North Shore vs. South Shore: Historical differences in property values and community appeal.

Urban vs. Suburban Living: Trends toward suburban living influenced by remote work and lifestyle changes post-pandemic.

Emerging Areas: Check neighborhoods that are seeing revitalization and increased demand. Google this for information.

Future Outlook

Looking ahead, the real estate market in Nassau County in the coming months and years will likely be influenced by several factors: Lower interest rates, which hopefully will occur, and increased inventory (which I do not see in the foreseeable future)

Policy Changes: Local government policies regarding housing, zoning, and taxes can impact market dynamics. This will be one of the crucial factors to assist in adding to our lacking housing inventory.

Technological Advances: The rise of virtual tours and online transactions may continue to shape how buyers and sellers interact.

Sustainability Trends: Increasing demand for eco-friendly homes and developments can influence market offerings.

The real estate market in Nassau as of August 2024 is the reflection of broader economic trends, local conditions, and demographic shifts. By analyzing key statistics such as median home prices, inventory levels, and days on the market, stakeholders can gain insights into the health and direction of the market. As we move forward, understanding these dynamics will be essential for buyers, sellers, and investors alike.

References: MLS.COM

(MLS.COM)

Philip A. Raices is the owner/Broker of Turn Key Real Estate at 3 Grace Ave Suite 180 in Great Neck. For a free 15-minute consultation, value analysis of your home, or to answer any of your questions or concerns he can be reached by cell: (516) 647-4289 or by email: Phil@TurnKeyRealEstate.Com or via https://WWW.Li-RealEstate.Com