Continuing our discussion on the national debt, we can look at how to reduce it. There are a few points to keep in mind discussing this, and the first thing is to know what debt actually is.

- The debt is the sum of all unpaid taxes from all revenue sources. Personal, corporate, tariffs, fees and other revenues comprise this sum.

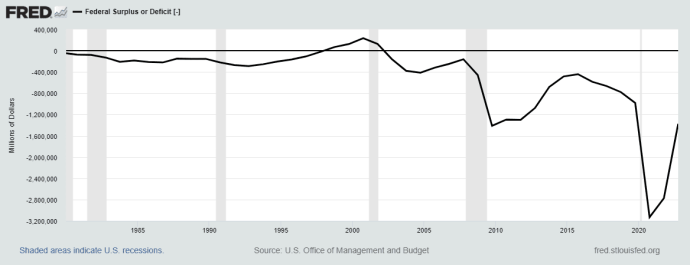

- The debt is the sum of all previous deficits in past fiscal years.

- As important as the debt in nominal (dollar) terms is the debt level expressed as a percent of GDP.

The reason the debt has been allowed to reach these levels is due to policy, especially since 2001, when President Bush executed two ruinous tax acts. Add in the loss in revenue due to the 2001 recession, Mr. Bush then proceeded to execute two wars a half world away without even the formality of budgeting for them, much less paying for them.

This teed up the coup de grace the administration engineered when the 2008 financial crisis hit. This is where government can learn a lesson as to how to manage its fiscal affairs. The crisis tanked federal revenues. Again, nothing is more ruinous to revenues than a recession, and this one was one for the ages. But the government faces a dilemma during these episodes because it has no choice but to increase spending to support a floundering economy, unless you prefer food riots and Hoovervilles. So while less is coming in, government has no choice but to spend more.

Your debt “crisis” then morphs into a permanent state because no one has the courage to raise taxes once these episodes are over to replace the expended funds. In my previous piece, I likened this to dropping a baton several times in a foot race. Unless there’s some way to “double time” it back in the race and catch up, the debt level never gets back to where it was before the crisis started.

This triggers the criticism that “government spending is out of control.” This is hardly the case. Tax policy is simply structured to fail. It’s designed to produce more debt and create a pretext for destructive policies.

When it comes to increasing revenues, there are a million ways to skin a cat. Tax policy has been heavily skewed to benefit the wealthy and corporate interests. If you want to see economic equilibrium restored to a sensible level, here are a few ideas.

One is to phase out the mortgage interest deduction. This may have made sense once, but all we’re doing is needlessly inflating the cost of existing housing and making it even more unaffordable. That’s pretty bad policy. The banks and the National Association of Realtors will scream bloody murder, because higher prices mean higher profits on mortgages and commissions. But it’s not productive and eliminating it might encourage a wiser use of personal debt. Since renters can’t take advantage of it, one might say it’s manifestly unjust. Losses to the Treasury are estimated to be between $70 billion to $175 billion.

We tax labor at three times the rate of capital, and the wealthier the earner, the more benefit is accrued to them. I would advocate a modest increase in the capital gains rate from 15% to 20%. When the market is rallying, capital gains do capture a sizable amount of revenue.

An upward shift in the top marginal rate is both warranted and necessary.

The corporate tax policy passed under the previous administration should be scrapped. Contrary to the woeful ignorance of the American voter, American corporations did not pay a 38% tax rate. The effective rate the largest corporations paid was well under 20%, and now it’s down to 9%. There was a global minimum tax of 15% passed by the OECD. Joe Manchin blocked our ascension to the agreement.

One of the biggest grifts flying under the radar is the abuse of the 501(c)3 tax shelter. The American taxpayer is floating the costs and outrageous salaries of thousands of organizations that are of little public benefit. Pro tip: if the CEO is earning over a million dollars a year, chances are they shouldn’t qualify as a (sic) “non profit” and the rules need to be tightened.

The key to debt control is to eliminate the deficit on a sequential annual basis. Tipping revenue growth in a more positive trend will achieve this goal.

Donald Davret

Roslyn